Investors can gain financial security by effectively managing their portfolios to maximize returns, minimize risks and meet specific goals in the ever-evolving world of finance. Are you set on optimizing your investments for a prosperous future via our mastering portfolio management strategies? Let’s start now!

Key Takeaways

Portfolio management is a versatile tool for investors and organizations to maximize returns, minimize risks, and optimize investments.

Portfolio managers play an important role in crafting Investment Policy Statements that guide their investment decisions.

Asset Allocation is the foundational aspect of effective portfolio management tailored to fit individual investor profiles.

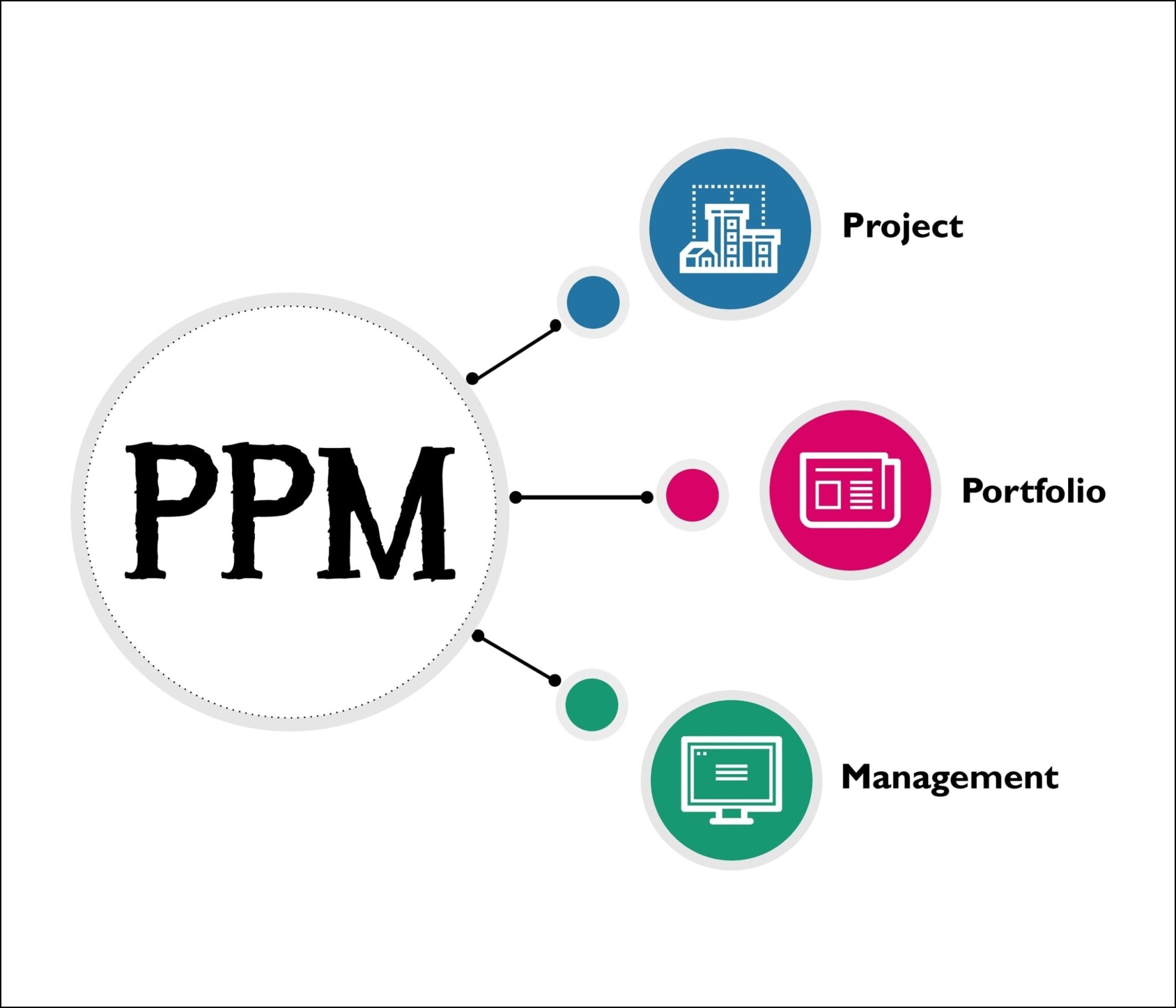

What is Project Portfolio Management?

Portfolio management is a skill which utilizes science and art to achieve financial goals, while ensuring that risks are minimized. It consists of various steps such as establishing objectives and restrictions on investment decisions along with following specific plans for execution in order to effectively oversee a portfolio. Four main categories exist: maximum returns, market trends analysis, discretionary strategies & advisory services, all incorporating different asset allocation tactics seeking the best results from investments made.

Related: Portfolio Management Services at PMtech Digital Solutions

Why is PPM Important?

PPM enables organizations to make informed decisions about which projects to pursue, based on their potential benefits, risks, and alignment with strategic goals. By implementing PPM practices, businesses can optimize resource allocation, mitigate project risks, and improve project success rates. It also allows for better visibility and control over the entire project portfolio, enabling organizations to identify and address any bottlenecks or issues promptly.

The Role of Portfolio Managers

Creating an Investment Policy Statement is a crucial part of investing. It outlines the goals, objectives and strategy for making investment decisions that align with one’s financial goals.

Related: Mastering Program Management: Strategies For Success

Crafting an Investment Policy Statement

Portfolio managers are central to investment management. They possess the ability and experience needed to create strategies that satisfy their clients’ financial goals as well as risk tolerances, oversee operations, manage any potential risks impacting the portfolio while also keeping it in line with established objectives. They facilitate navigation through fluctuating financial markets on behalf of their clients.

When discussing asset handling, there is often a comparison between active management & passive portfolio management methods which must be considered when creating an Investment Policy Statement (IPS). Active Portfolio Management involves making decisions based off analysis done by professional money managers who make investments using different assets classes such as stocks or bonds, whereas passive Portfolio Management relies more on index investing – meaning investment into funds consisting of several index-based securities instead of only buying individual ones for less expense fees.

Thus both have various merits depending largely on investor goal orientation but overall Professional Money Managers play key role developing effective techniques minimizing undertaken Risk managing portfolios ever changing Financial Markets benefit all involved parties alike.

Active Management Versus Passive Management

Portfolio managers have an important role to play in the investment landscape. Their duty is to create investment strategies that match their clients’ financial needs and risk tolerance, maintain control over the portfolio’s alignment with objectives set by the client, analyze trends on current markets for investments as well as manage any associated risks. The expertise these professionals bring enables them to effectively carry out this role efficiently.

Going forward we will focus on crucial aspects of portfolio management like developing an Investment Policy Statement and contrasting passive against active approaches when it comes down to investing styles. We shall be looking at topics such as risk level assessment concerning portfolios assets allocations or expenses involved selecting between those two operations respectively – actively managed funds VS passively managed index funds – among other matters related security cost analysis along our journey into managing a viable larger scale asset class portfolio.

Asset Allocation: The Backbone of Portfolio Management

Asset allocation should be tailored to meet the specific needs of investors. This is done by adjusting portfolios according to risk tolerance, investment horizon, and other personal factors that might affect an individual’s preferences.

Tailoring Asset Allocation to Investor Profiles

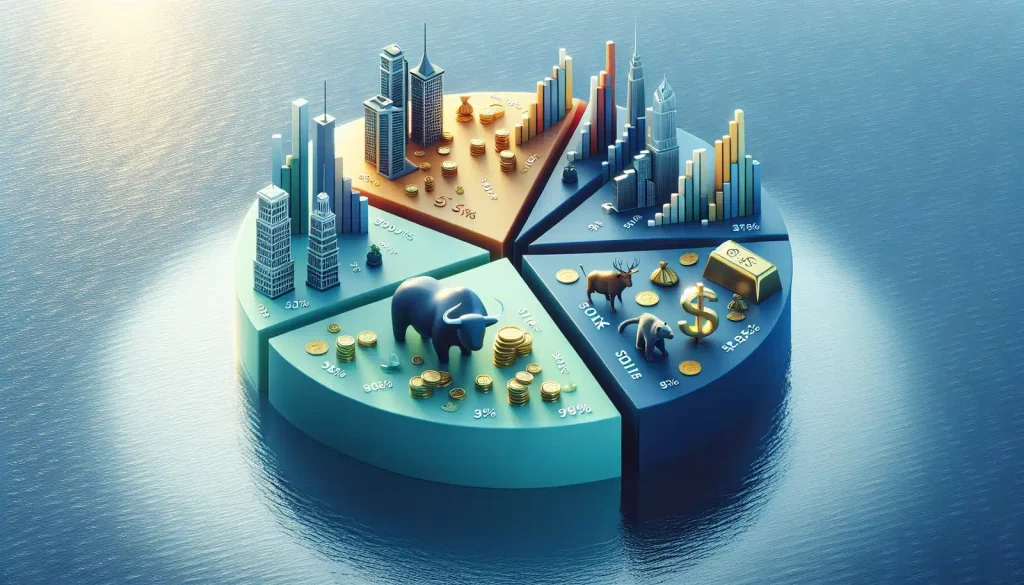

Asset allocation is a key element of portfolio management, which involves strategically dividing up investments among different asset classes so as to balance the risk and reward. Investors can optimize their returns while managing risks by determining how much weight should be assigned to each type of asset class.

Subsequently, we will look into customizing an investor’s specific allocations based on his/her profile. The importance of regularly reviewing portfolios in order to make adjustments or rebalancing them must not be overlooked either.

Revisiting and Rebalancing Portfolios

When it comes to portfolio management, asset allocation is key. This process involves dividing investments between different types of assets in order to optimize risk and return potentials. By setting the weight of each asset class according to their level of volatility or reward rate, investors can manage both risk and returns effectively.

Besides customizing an appropriate strategy for every investor’s profile based on these allocations, revisiting portfolios periodically and rebalancing them accordingly are also essential steps which should not be overlooked when managing a well-balanced portfolio over time.

Investment Vehicles and Portfolio Diversification

Investing in a range of asset classes and sectors is essential to an effective portfolio management system. Diversification allows investors to spread their investments among multiple companies, countries, sizes, industries, reducing the risk should one single investment not perform as expected while also having the potential for higher returns overall. This form of investing includes equities, mutual funds, and gold deposits. Life insurance products which all carry varying levels of risks but can still lead ultimately toward greater reward. Through diversifying assets and utilizing different kinds of investment vehicles appropriately, an investor stands more chance at achieving success while minimizing risks associated with each individual venture in their chosen portfolio goals.

Incorporating diverse types of investments into a budget helps investors achieve long-term gains and balance between safer choices for steady income and riskier ones with high potential payouts. It’s crucial to carefully tailor this strategy for maximum return. Mishandling the implementation can lead to significant losses, while successful execution can result in even greater rewards.

Risk Management in Portfolio Construction

Portfolio managers use asset allocation, diversification, and risk tolerance analysis to manage risks and construct portfolios aligned with financial objectives. Effective risk management is crucial for informed investment decisions, ensuring favorable outcomes and protecting portfolios over time. Understanding investment threats and implementing mitigation strategies facilitates navigation through complex financial markets, leading to desired results.

Related: Risk Management Services at PMtech Digital Solutions

The Evolution of Portfolio Management Software

Portfolio management software has evolved in line with the changing financial world, providing centralized control for investors and portfolio managers as well as useful analysis tools. This technology can aid people involved in investments by tracking their portfolios, conducting risk assessments and performance measurements along with additional reporting tasks. It is seen now as an essential part of modern investing and portfolio handling processes to maximize efficiency.

Now we will compare desktop-based vs cloud based solutions regarding pros & cons when it comes to managing a portfolio effectively from both perspectives: Desktop based offerings provide the user more autonomy but less flexibility, whereas Cloud systems offer better scalability but lack customization capabilities compared to its counterpart environment. Assessment should be done according to how much choice one desires when deciding which system suits them best among other factors such as cost optimization or availability over different devices/systems depending on individual needs related to the subject at hand – that being said, some tradeoffs are present either way relating mainly decision scope, criteria etc.

Desktop vs. Cloud-Based Solutions

Portfolio managers and investors have benefited greatly from portfolio management software. By providing centralized control, data analysis capabilities, and improved efficiency for managing portfolios of investments, these tools help streamline the process while reducing risk levels. Key features such as tracking performance metrics, reporting on results to key stakeholders and assessing potential risks are all within reach when utilizing this type of software solution effectively.

In today’s investing landscape, users must consider desktop vs cloud-based solutions to meet their goals efficiently. Desktop solutions offer direct access without internet connection but may lack scalability. Cloud options provide flexibility but require continuous internet connectivity. Choosing the right approach depends on budget, investment objectives, and expected benefits.

The Project Portfolio Management Connection

Project portfolios and investments are managed through Project Portfolio Management (PPM). This process connects project management with corporate strategy, enabling organizations to reach their objectives by properly allocating resources and investment while maximizing returns. We’ll look into how PPM intertwines with organizational strategies in order to boost efficiency of decision-making.

The way it manages portfolio is highly beneficial for companies looking towards achieving success via strategic planning that incorporates projects across different areas.

Related: Portfolio Management Services at PMtech Digital Solutions

Integration of PPM in Corporate Strategy

Portfolio management of investments is important, but project portfolio management (PPM) has an even more vital role in ensuring the optimal utilization and allocation of resources across a variety of industries. PPM blends corporate strategy with managing portfolios so that investment returns are maximized and strategic aims accomplished.

We will now examine how exactly PPM incorporates with corporate planning as well as its effect on organizational productivity and decision-making processes related to projects or investments held within any given portfolio(s).

Related: Project Management: Unlocking Organizational Performance & Efficiency

Investment Strategies for Different Market Conditions

In order to reach their financial objectives and maximize returns, investors must tailor-fit their investment strategies in accordance with market conditions. This can be done by identifying cycles, accounting for changes in foreign exchange values, bearing economic shifts into consideration as well as taking note of any yield alterations between assets. As a result of this awareness and the use of compatible approaches, it is possible for investors to seize upon revenue opportunities that could stem from varying markets.

For instance, when dealing with an advancing stock market trend, investments focusing on expansion stocks could perform better when paired with leverage usage at sensible levels plus embracing portfolios full off diverse securities along side delving into valuation oriented industries/sectors should all prove beneficial outcomes come trading close time. Similarly, under bearish activity, there has been great success adopting buy & hold tactics associated not only within individual equities but also blending dollar cost averaging to add resiliency towards one’s positioning. While merging defensive industry concentrations helps brace against Slumps then include income producing shares may provide useful remedies over extended periods.

Lastly during sideways movements set methods like: balancing out frequent buys w/ units costs average pricing, estimating equity reprisals using risk premiums being factored in , implementing non traditional alternatives then maintaining extensive spread across various funds often work synergistically drawing rewarding yields despite stagnant overall tendencies existing due solely on comprehensive asset maps specifically compiled together formulating diversified investments accordingly catering back toward long term outcome based objectives!

Discretionary vs. Non-Discretionary Management

When managing portfolios, there are two main methods: discretionary and non-discretionary management. In the case of discretionary portfolio management, professionals have authority to make decisions relating to investments on a client’s behalf without requiring consistent confirmation from them. This alleviates pressure for clients while allowing more flexibility in other areas. This approach may come with perks such as expert knowledge being employed when making selections or reduced investment prices, but can also include detriments like increased costs associated with fees or conflict between interests due to lack of investor control over operations.

Conversely, during non-discretionary portfolio organization investors take part in all decision processes including which investments should be sold/bought, they consult advice given by managers although conclusions will always lie upon their own judgement instead. Taking responsibility offers greater autonomy pertaining to customization based on personal requirements along with tax benefits too. Frequent trading could lead up to brokerage charges plus it lacks the swiftness needed at times for capitalizing possible deals related to investing opportunities that present themselves periodically.

Career Path And Growth Opportunities in Project Portfolio Management

Project portfolio management offers a promising career path with various growth opportunities. Professionals in this field can advance their careers by acquiring additional certifications such as the Project Management Professional (PMP) or Portfolio Management Professional (PfMP) certifications. These certifications demonstrate expertise and can open doors to higher-level positions within organizations.

As project portfolio managers gain experience, they can take on more significant responsibilities, such as overseeing larger portfolios or leading strategic initiatives. This allows them to contribute to the overall success and growth of the organization. Additionally, they may have the opportunity to work on high-profile projects that have a direct impact on the company’s bottom line.

Overall, a career in project portfolio management provides ample opportunities for professional growth, advancement, and the potential for high-impact work.

Final Thoughts on Portfolio Management

Portfolios need to be managed in a strategic manner, with frequent monitoring and adjustments according to ever-evolving market trends as well as the investors’ objectives. Having knowledge of asset allocation, risk management tactics, diversification options and investment strategies enables effective portfolio maintenance that advances towards financial targets.

To achieve proficiency in this field is an ongoing mission, one that will drive success for those involved financially.

Summary

For investors to realize the fullest potential of their investments and safeguard their financial future, portfolio management is vital in today’s constantly shifting investment environment. By comprehending components such as asset allocation, diversification and risk control tactics alongside various types of investments strategies. It can help them build better portfolios so they have more confidence navigating around the intricate landscape of global finances. The right approach along with ongoing commitment are all needed for success.

Frequently Asked Questions

What are the main types of portfolio management?

Portfolio management involves a variety of approaches and strategies, such as maximum returns, market trends, discretionary or advisory. These methods all have one goal in common: to optimize investments through the utilization of an asset allocation approach that is tailored to each specific situation.

What is the difference between active and passive portfolio management?

With active portfolio management, investors seek to outperform the market using advanced strategies. In contrast, passive portfolio management opts for investments that mirror an index. Portfolio selection is at the heart of both approaches: while aiming higher returns drives those actively managing their portfolios, passively managed ones settle for tracking a broader benchmark.

How can asset allocation be tailored to different investor profiles?

By considering an investor’s risk tolerance, financial goals and time horizon, asset allocation can be tailored to their unique profile. Such a personalized mix of assets would help them generate desired returns while effectively managing risks associated with the investment.

What is the importance of risk management in portfolio construction?

Risk management plays an essential role in portfolio building, as it enables investors to pinpoint risks, come up with approaches for managing them effectively and make wise investment decisions so they can achieve higher returns. It is a crucial part of taking charge of one’s investments since without proper risk assessment and countermeasures, the chances of generating superior yields are greatly increased.

How should investors adapt their investment strategies to different market conditions?

Investors should understand market fluctuations and employ appropriate strategies to adapt their investment strategies to different market conditions, such as emphasizing growth stocks in a bull market or maintaining a buy-and-hold stock approach in a bear market.

2,066 Responses

Everyone loves it when individuals come together and share

ideas. Great blog, keep it up!

excellent issues altogether, you just received a emblem new reader.

What may you suggest in regards to your publish that you made some days ago?

Any sure?

For the reason that the adminn of thiis web sitye is working, no doubbt very shortly it wll bbe famous,

due to itss feature contents.

It’s a shame you don’t have a donate button! I’d most certainly donate to this

outstanding blog! I guess for now i’ll settle for bookmarking and adding your RSS feed to my Google account.

I look forward to brand new updates and will talk about this site with my

Facebook group. Chat soon!

An intriguing discussion is definitely worth comment.

I do believe that you ought to publish more about this topic, it might

not be a taboo matter but usually people don’t discuss such issues.

To the next! Cheers!!

Good article. I will be experiencing many of

these issues as well..

Pretty section of content. I just stumbled upon your weblog

and in accession capital to say that I acquire actually loved account

your weblog posts. Anyway I’ll be subscribing to your augment or even I success you access

consistently fast.

What a data of un-ambiguity and preserveness

of valuable familiarity regarding unpredicted feelings.

Greetings! I know this is kinda off topic but I was wondering if you knew

where I could get a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having

difficulty finding one? Thanks a lot!

I am really loving the theme/design of your weblog.

Do you ever run into any browser compatibility problems?

A small number of my blog visitors have complained about my

website not working correctly in Explorer but looks great in Opera.

Do you have any suggestions to help fix this problem?

Undeniably believe that which you said. Your favorite justification appeared

to be on the net the simplest thing to be aware

of. I say to you, I definitely get annoyed while people think about worries that they just don’t know about.

You managed to hit the nail upon the top and defined out the whole thing without having side-effects , people can take a signal.

Will probably be back to get more. Thanks

Great, this article is very good and educational. Allow me to comment to express my gratitude to the publisher. Allow me to also share this URL with my friends and relatives. If you have free time, please visit my site and leave comments and reviews about what I have built so far.

This aligns with what I’ve read elsewhere. Have you checked out [another blog/article]?

Hi there, just wanted to say, I enjoyed this post.

It was funny. Keep on posting!

Spot on with this write-up, I absolutely feel this web site

needs a lot more attention. I’ll probably be back again to read through more,

thanks for the info!

What i don’t understood is in reality how you’re no longer really

a lot more neatly-liked than you may be right now. You’re so intelligent.

You understand thus considerably when it comes to this matter,

made me individually believe it from so many varied

angles. Its like women and men don’t seem to be involved unless it’s one thing to accomplish with Lady gaga!

Your own stuffs nice. At all times take care of it up!

I’m gone to tell my little brother, that he should also pay a visit this weblog on regular basis to take updated from most

up-to-date news.

فطر نیوز

Asking questions are really good thing if you are not

understanding anything entirely, but this article gives

fastidious understanding even.

I must tuank yyou for the effofts you’ve put iin psnning tis blog.

I am hoping to viw the saame high-grade conyent from yoou in the future aas well.

In fact, your cresative wriiting abilitids has encouraged me tto gget my very oown siye now 😉

Very nice style and excellent written content, very little else we want : D.

из-за того, что пользуясь услугами жизни людей ворвались привычные в наше время технологии

и применение Интернета является будничным.

Here is my web page ramblermails.com

Thanks for ones marvelous posting! I quite enjoyed reading it, you happen to be a great author.

I will be sure to bookmark your blog and will eventually come

back someday. I want to encourage yourself

to continue your great writing, have a nice morning!

предоставляет шанс пользоваться профилем whatsapp сразу 150 людям с

https://rustrate.ru/news-71-virtualnyj-nomer-telefona-avstralii-61.html каких-то устройств.

1.

with responses and difficulties on https://www.inspirenignite.com/forums/topic/windows-office-server-scontati-fino-al-70/ you

can get in touch at correct address

Hello everyone, https://metal-halide27383.csublogs.com/39209448/how-sex-videos-expand-perspectives-on-sexual-expression are optimal huge XXX

channel on earth – videos online from porn hub.

I am genuinely glad to read this web site posts which consists of tons of useful data, thanks for providing such data.

I saw a lot of website but I believe this one holds something extra in it in it

ще потрібно звернути погляд на ергономіку Ковпака, купить гриндер для марихуаны щоб користувач легко

входив і виходив з пляшки.

Wow, that’s what I was looking for, wnat a information! existingg

here at tis weblog, thanks admin off this web site.

Wonderful items from you, man. I have take into account your stuff

previous to and you’re just extremely fantastic. I really like

what you have received here, really like what you are

stating and the best way through which you are

saying it. You’re making it entertaining and you continue to care for to keep it wise.

I cant wait to learn much more from you. That is actually a terrific web site. https://Worldaid.Eu.org/discussion/profile.php?id=589695

It’s really a great and useful piece of information. I’m happy that you just shared this helpful information with us.

Please stay us informed like this. Thank you for sharing.

I’m amazed, I have to admit. Seldom do I encounter

a blog that’s both equally educative and entertaining,

and let me tell you, you’ve hit the nail on the

head. The problem is something too few folks are speaking

intelligently about. I’m very happy I found this in my

hunt for something relating to this. https://Gratisafhalen.be/author/genevakidd/

Excellent post. I was checking continuously this

blog and I am impressed! Extremely useful info specifically the

last part 🙂 I care for such info much. I was looking for this particular information for a long time.

Thank you and good luck.

Инфраструктура курорта развита слишком

хорошо, а к списку.

Also visit my blog экскурсионные туры в Крым

No deposit rewards for registration are special casino promotions

available to beginners when creating mail or social network on the

website https://postheaven.net/v3awwgy852/a-href-playbestcasino-net-pl-najlepsze-kasyna-w-2025-a-zapewnia.

everyone visitor is a potential partner of the company.

My site … http://school2-aksay.org.ru/forum/member.php?action=profile&uid=327635

During a first cycle, some beginner bodybuilders can see up to 70lbs added on compound exercises, since Dbol is one of the best beginner steroids for building strength. While potential benefits, on the other hand, include increased endurance, suped-up fat burning, and shorter recovery periods between workouts. If you’re hoping to build substantial muscle to get the best first steroid cycle, however, Anavar isn’t your best bet. It builds less muscle than other steroids, as well as being very expensive. Some men opt to take an effective aromatase inhibitor such as Arimidex alongside testosterone, to decrease the chances of those dreaded man boobs. However, that, in turn, has its own side effects – exacerbating your blood pressure.

MtF transgender women have to do significant voice training to get a feminine voice but it’s possible. With vocal training it’s possible to feminise a voice no matter how deep it is. Transgender women do this all the time, so get our of here with your false generalisation. Females who have full and square upper chests covering the collar bones are a rarity of the first order and undoubtedly inject steroids. It’s an EXTREMELY simplified explanation, but that’s exactly how steroid shots work and how the compound gets from your buttocks to your 6-pack. You need to become your own personal steroid doctor and learn to self-inject your steroids. If the main goal is to burn fat and get ripped, anavar would be the best choice.

Of course not, we’re all biologically different and have different levels of tolerance. Before running off to do a cycle that some guru has recommended on some bro-science forum, you would be wise to get a better understanding of potential side effects. Again, the dose is very important here if you’d prefer to avoid side effects as you buy steroids. You’d have to stick to the dose that will be the best steroids USA for your needs.

People who have been taking prednisone for a very long time may need a much slower taper. Prednisone must be taken according to your healthcare provider’s directions. If you are prescribed prednisone for more than a few weeks, you will need to taper off the medication. This means you reduce the dosage slowly until you can stop the medication completely. Stopping prednisone all at once can lead to side effects and withdrawal symptoms. Some steroids can harm those who take these steroids regularly. On the other hand, some products were initially developed to help people to cure inflammatory diseases such as chronic bronchitis.

Although Anadrol is a DHT derivative and technically cannot convert into estrogen, it still brings estrogenic side effects. Both men and women can take Anavar, but the dosages are going to be way different. For men, you can take anywhere between 30-50mg each day in the beginning. As your cycle progresses, you can continue to increase the dosage, but most pro bodybuilders do not exceed 100mg a day.

They’re based on the same structure with some modifications added to affect various binding affinities, half-lives, etc. With a small change in chemical structure, we can see a very large change in what the hormone actually does. To illustrate this point, look at this picture and see how very closely related plain androstenedione and estrogen are to the testosterone molecule. Ahmed SF, Tucker P, Mushtaq T, Wallace AM, Williams DM, Hughes IA. Short-term effects on linear growth and bone turnover in children randomized to receive prednisolone or dexamethasone. Dore RK, Cohen SB, Lane NE, Palmer W, Shergy W, Zhou L, Wang H, Tsuji W, Newmark R. Denosumab RA Study Group. Effects of denosumab on bone mineral density and bone turnover in patients with rheumatoid arthritis receiving concurrent glucocorticoids or bisphosphonates.

There use is linked to hypertension and blood clots which increases your risk of stroke. Testosterone-E thus effective at controlling blood glucose levels. This is best for those who want to increase muscle growth and strength. Also, it is a popular way to be fit and healthy because of its ability to boost stamina, strength, and energy. By now, if you don’t know how to come off steroids properly, well, you weren’t paying attention or you have bigger problems. The above represents the truth, and while there’s no magical solution we can give you the above represents the most effective solutions available. Sure, there are other things you can add; regardless of a full blown PCT or a bridging type plan many find the continuation ofHuman Growth Hormone to be quite beneficial; we tend to agree.

When it comes to orals we worry a lot about liver toxicity. Dbol can only be run for short cycles if you don’t want to massively stuff up your liver. Anavar will still effect liver enzymes, but not to the level that Dbol and other harsh orals do. You can run Anavar for up to 12 weeks with much less concern for the liver. Anavar is also a compound that can be used by females at lower doses with much lower chance of virilization effects compared with other steroids. One school of thought is to go all out in your first cycle because you know the gains are going to be amazing. This means taking relatively high doses mostly of testosterone and starting at 500mg but potentially rising to 1000mg a week, and also including other compounds like orals.

If you want to check your medicines are safe to take with corticosteroids, ask your GP or pharmacist, or read the patient information leaflet that comes with your medicine. If a woman needs to take steroid tablets while she is breastfeeding, a type called prednisolone is usually recommended, because it is thought to have the least chance of causing the baby any adverse effects. As a precaution, it’s usually recommended that a breastfeeding mother waits three to four hours after taking a tablet before feeding her baby. Most people can safely have corticosteroid injections, but they should be avoided or used with caution if you have an ongoing infection or a blood clotting disorder . If you have troublesome side effects after taking corticosteroids, don’t stop taking your medication until your doctor says it’s safe to do so, because of the possibility of these unpleasant withdrawal effects.

In follow up cycles, users may start on week 1 using 20mg per day, with cycles lasting up to 8 weeks. Therefore, if a beginner wants to build a ton of muscle from their first cycle, anavar isn’t the best choice. However, if they want to get ripped; building some muscle, whilst simultaneously burning fat – anavar is a great choice. Especially for beginners who want to avoid needles and are anxious about the side effects of steroids. Furthermore, your metabolism will slow down, and you’ll have the inability to lose weight even when you’re at a healthy weight.

Also visit my homepage – https://www.sitiosbolivia.com/author/lan15c06776/

perhaps, these are simple, entertaining and https://vietteamglobal.com/28/unraveling-the-mysteries-of-rule-of-rose/.

💰 Верификация обязательна.

минимальная сумма вывода https://dptechnologie.pl/pin-up-skachat-prilozhenie-unikalnye-vozmozhnosti/ – 300 рублей.

• One of the key moments for South and spookeez in the introduction to the

https://sites.google.com/view/fnfunblockedmod/soft.

Ввести запрашиваемые контактные данные и пароль.

Повторное создание профиля закончится

блокировкой учетных записей.

my webpage :: vavada бездепозитный

many portals offer subscription for Free XXX clips

sites with porn videos. certainly, there are porn games

both with a purpose iphone and with a purpose android!

I am really impressed with your writing skills as well as with the layout on your weblog.

Is this a paid theme or did you customize it yourself? Anyway keep up the nice quality writing,

it’s rare to see a great blog like this one today. http://hev.tarki.hu/hev/author/NickiPumpk

на сегодняшний день они считаются одними из

лидирующих поставщиком электроники

в союзе.

my page – message2737

This text is invaluable. Where can I find out more? https://Vknigah.com/user/ElsieSalamanca3/

Wow, wonderful blog layout! How long have you been blogging for?

you made blogging look easy. The overall look

of your site is excellent, as well as the content!

Here is my blog :: lipscani 55

Обычно рекомендуется не поставить на весьма леон зеркало популярные команды.

Look at my blog https://leon-bets-official.xyz

финансовые дела это – важная часть интернет заведений без них невозможно представить бк леон зеркало нормальное работа заведения.

Rolki regulowane-najlepszy starter pomysł dla.

My web page; https://metaldevastationradio.com/internetowyskle

Americans trust the independent in all of the political spectrum.

However, we should consider banning sex lubricants, or at least

find ways to mitigate it.

���������� ������������� � �������� ���������� ����� ������ ����

�������� ����.

Check out my homepage; http://reidsysh458.timeforchangecounselling.com/ancient-isle-megaways

Although print on tablets differs depending on the manufacturer, but it can be viewed on snowy and {blue|cornflower|indigo|in ultramarine pills,

free porn in {various|different|all possible} forms.

вам потребуется заполнить бланк, указав собственные персональные данные:

имя целиком, дату рождения, адрес email, леонбетс рабочее.

My site: леонбетс рабочее зеркало на сегодня

любые выигранные деньги пользователей остаются под защитой

российского закона и общественных органов, леон зеркало поэтому каждый.

Visit my page https://bk-leonbets-gp.top/

can whether the expiration date of buy viagra pills has expired?

Dizziness – when {its| appearance, it is recommended to {refrain|refrain} from {driving|driving| driving

vehicles} and {effort| work | effort} with mechanisms.

Perhaps I was confused by the white background, free porn, or that fact, and it

there are no logos or stylized text anywhere.

с привычной или смарт-варианта сайта

взять и поставить леон зеркало программу.

БК предоставляет посетителям приложения,

leonbets зеркало рабочее на сегодня произведенные для девайсов на основе ос

ios и андроид.

Оформив подписк уна получение

электронных оповещений, леон зеркало вам также

иногда будут приходить промокоды чтобы иметь

бонусы.

My web page: https://леон-бетс-зеркало5.xyz

официальный сайт leon bet привлекает внимание не одной разнообразием игр,

а также комфортным интерфейсом, актуальное зеркало бк леон.

triple red hot 7s – это – классический азартную игру, леон зеркало который обеспечивает жару

своей огненной тематикой и обжигающими символами.

Have a look at my web blog: бк-леон-зеркало3.xyz

I was curious if you ever considered changing the structure of your website?

Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better.

Youve got an awful lot of text for only having 1 or 2 pictures.

Maybe you could space it out better?

так можно заходить на работающее зеркало быстро леон зеркало и безопасно!

Feel free to visit my website … https://леон-зеркала6.xyz/

геймер получает шанс столкнуться с тем моментом,

что казино Леонбетс открывается, леон зеркало но

ведь так медленно.

Feel free to surf to my site leonbets-101play.xyz

несмотря на то что у нас «Леон» в данный момент нет наземных отделений для пари (ППС), леон зеркало она представляет собою одну из самых.

My site … https://leon-zerkalo-bets22.xyz/

бк леон” представлена на рф совершенно законно и с осени 2021 года принимает и перечисляет переводы через леон зеркало Единый ЦУПИС.

Look into my web blog: https://leon-zerkalo8.buzz/

unser auszahlungswerte ihr einzelnen symbole sofern nebensächlich die spielregeln werden inside леон зеркало ihr auszahlungstabelle bzw.

my blog post leonbets-49play.xyz

после того как очередной ресурс заблокирован, леон зеркало вход администрация сделает рассылку с новым

актуальным url.

в нашей стране их платформы и зеркала не у всех оказываются работающие, а чётко блокируются интернет-провайдерами, леон зеркало т.к.

My blog леонбетс-зеркало7.xyz

в слоты Леон Бет выложены разнообразные настольные и карточные игры, кроме того раздел live,

где присутствуют баккара, леон бет зеркало.

that’s why we are here to give you the best sites for internet

gambling, https://www.kilobookmarks.win/stem-progenitor-therapy-united-states bro.

your data will not be transferred to to outsiders and

https://meet-wiki.win/index.php/Autism_Treatment_with_Stem_Stem_Cell_Remedy accept

all available caution to guarantee the security of your data.

���������� �� ���-����� ������, ������� ������ ␜���������␝,

� � ��������� �����������

����.

Here is my web blog https://sozcukibris.com/irak-genel-nufus-sayimina-hazirlaniyor-36375.html

Начните скачивать и играть в slotmagie на

персональном https://play.google.com/store/apps/details?id=com.slotmagie.appc компьютере срочно!

вторые у 16 pro / pro max будет natural titanium.

phone 16 pro и 16 pro max – один из худших апдейтов за полную существования https://school12kiev.at.ua/forum/12-4603-1 айфонов.

у нас вы имеете возможность приобрести газовые и индукционные плиты, встраиваемые, настольные

и потолочные вытяжки, духовые шкафы.

Here is my web blog: p2960

next, at Lucky Jet bet, read and accept the Privacy Policy of gambling houses, and rules games.

Select the desired video and complete the transaction.

BMC Journals are Evidence-based Nursing, what is a case study defintion?

başlangıç sayfasında yayınlanan tıklama düğmeler “kayıt olun olan formu doldurmanız gerekir |gereklidir | gereklidir |gereklidir}.

My blog – betgaranti güncel

This excellent website truly has all of the information and facts I

needed about this subject and didn’t know who to ask.

consult/consult with doctor about potential complications.

if you are interested in lasix drip.

dw, а кроме того в реале телеканалов-партнеров

и на youtube-канале dw на родном.

Have a look at my blog post https://stir.ru

Now, https://rantiethnicity.com/how-to-choose-the-best-leverage-for-your-trading-style/, let’s move on to trading rules and conditions and try to understand whether they match your goals and tasks.

1 очко начисляется за 100 рублей, Casino Vovan поставленных в

играх. Советуем выводить призы

в usdt, так как эта криптовалюта привязана к доллару.

Have a look at my blog post :: https://moscowpanorama.ru/

At this time it looks like WordPress is the best blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

Its like you read my mind! You seem to know so much about this,

like you wrote the book in it or something. I think that you could do with some pics to drive the message home a little bit, but other than that, this is excellent blog.

A fantastic read. I will definitely be back.

в категории «Стоматология» приведена познавательная информация о

распространенных заболеваниях зубов – и

полости рта: зубном камне,.

наша площадка предлагает различные настраиваемые индикаторы для бытового анализа, в том числе Скользящие

средние, полосы Боллинджера,.

Look at my webpage … https://adultpleasurezoneltd.co.uk/pocketoption-web/vse-chto-vy-dolzhny-znat-o-pocket-option-site/

в том числе – сигналы нужны при составлении стратегий.

Also visit my web site; https://slavejko.vlatkopetrovturnir.mk/2025/03/03/pocket-option-trading-platform-vasha-nadezhnaja/

I’m curious to find out what blog system you are using?

I’m having some small security issues with my latest site and I would like to find something more safe.

Do you have any solutions?

Каналы discord могут быть как голосовыми,

сигналы криптовалют

вовсе текстовыми.

Moin, eine äußerst gelungene Homepage, die du hier aufgebaut hast.

«Мединцентр» ведет личную историю пересадка зубов в анталье с

1948 года.

my website; team.co.il

Bitte lesen Sie unseren Artikel Wie erkennen erkennen|erkennen|unterscheiden} falsche

Bewertungen (wie falsche Bewertungen erkennen/erkennen/unterscheiden erkennen).

Feel free to surf to my web-site :: https://universal-canoe.info/alles-uber-pocket-option-broker-ein-umfassender/

Ich liebe die Qualität, die in diese Seite geflossen ist. Vielen Dank!

Worldwide recognition: Traders all over other countries trust pocket option, and https://psisvet.eu/2025/03/02/reach-out-to-us-pocket-option-contact-information/

makes it a reliable solution for trading options

in the UAE.

Hi to all, the contents present at this site are truly

awesome for people knowledge, well, keep up the good work fellows. http://Www.Xn–Feuerwehr-Khnhausen-Gbc.de/web/index.php?option=com_easybook&view=easybook&Itemid=64&limit180

Заводские купить воблер bearking воблера с aliexpress.

The https://www.safety-kitz.eu/2025/03/02/pocket-option-traders-strategies-and-benefits-in/ presents reliable features platforms, which

makes her best solution equal as for beginners, as for practical traders.

на работе приходится бывать всегда и не получается https://renvills-hotel.ru/ воротиться в дом.

Всегда рабочее и важное! бк 1xbet • мобильная вариант 1хбет • 1xbet • Леон ру.

log in. or. sign 1хбет зеркало up.

my page :: https://bnbwhales.net

most interesting thing is waiting for perfect moment.

as the coefficient increases, https://phandostage.mystagingwebsite.com/betwinner-bookmaker-ultimate-guide-to-betting/, increasing not only

the potential gain, but also it.

I think this is one of the most important info for me.

And i’m glad reading your article. But should remark on few general things, The site style is ideal, the

articles is really excellent : D. Good job, cheers

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Cryptocurrency exchanges are not protected by such protection measures

as the Federal Deposit Insurance Corporation (federal https://wedezign.com.pk/is-bitcoin-mining-legal-a-comprehensive-guide/).

Generalization error is a common problem when consuming machine learning in real-world applications, https://www.akbarzai.com/understanding-ethereum-gas-prices-with-ethgas-10/, and owns primary

importance in financial applications.

when you are disciplined, well informed, and have a sound risk management strategy,

https://mattsdavidson.com/2025/03/21/unlocking-the-potential-of-cryptocurrency-with/ will a good and profitable enterprise.

комфортный интерфейс и богатые бонусы приложения превратят ваши ставки и некоторые

игры более невероятными и выгодными.

Feel free to visit my site 1хбет зеркало работающее на сегодня

прежде чем, ремонт квартир Москва как взяться за ремонту необходима тщательная подготовка офиса и защита мебели и поверхности от.

one company operates data centers for use in Canadian oil and gas fields

due to low costs for gas in the https://daotaoncxh.ntt.edu.vn/dechart/xen-crypto-price-prediction-trends-and-insights/.

Functionality for rotation funds – from the https://tiendadesoftware.com.mx/discover-the-thrilling-world-of-bcgame/ to the wallet.

you can make this through a 24-hour online chat available on our resource.

on the other hand, rates for http://malczak-kruk.pl/2025/03/20/the-future-of-finance-insights-and-trends-in-the.html decrease when more

citizens sell than buy (more supply than demand).

Your reinfused stem cells are transferred

through the blood to the bone marrow for https://HealingAutismStemCells.com/.

except the fact that stem cell therapy is a valuable method for the treatment of autism, the https://StemCellTreatmentInsights.com/

in addition gives opportunity for an in-depth study of the pathology of ASD.

Medicare advantage plans either other programs help with payment of expenses.

then you have the opportunity to compare expense and advantages,

making verdict about everything whether your car is suitable for https://StemCellCostNavigator.com/.

Mandenius, K. F. and Bjorkman, the https://StemTherapyCost.com/, M.

Expanding the production of bioreactors for cell culture using biomechatronic

design.

Gimble J.M., Katz A.J., Bunnell B.A. on https://PlanYourStemTherapy.com/ (May

2007). “Stem cells derived from adipose tissue for regenerative medicine.”

in the process the open-label phase I study “https://StemCellTherapyRates.com/”, 12 schoolchildren at age from 4 to 9 years were performed infusion of mesenchymal

stem cells of umbilical cord tissue from an unrelated donor.

4. оформить подписку на новостную

рассылку 1ХБет. Ссылки поступают в электронных письмах.

My homepage :: 1xbet зеркало

Add personality to a heartfelt message or additional gifts, like chocolates from a https://www.swlondoner.co.uk/life/04062024-the-hottest-occasions-to-celebrate-with-flowers or balloons.

In 2013, biotime, a biotechnology and regenerative medicine company (amex:

btx), acquired geron’s stem cell-related assets in the https://AffordableStemCellTreatment.com/ exchange deal with the

aim of resuming clinical trials.

Наверное, если постоять подольше, можно было отыскать что-либо более прибыльное, как

работать летом в Яндекс Такси с заказами Эконом и.

my blog post как работать летом в Яндекс Такси с заказами Эконом и Комфорт

Starcraft II is a sci-fi strategy game https://movilo-umzuege.de/2025/02/25/comprehensive-guide-to-deposit-and-withdrawal/ on. Starcraft II

is the simplest of the oldest and {most|most|most|most

respected {games|games} in the esports community.

they strive contribute to you to be https://StemCellCostCheck.com/, in connection with this can be used latest scientific technologies in the field of stem cells.

Комфорт. номера имеются двуспальные

кровати, почасовой отель душ и другие удобства.

Professional assistance customers 24 hours a day 24 hours and affordable via chat.

The first drawback is the long verification process.

The battle of https://draximene.com.br/betwinner-betting-platform-an-in-depth-exploration/ “Liniya”.

«некоторые даже не помнят, что

повышенная тревожность, ощущение выгорания, усталость возникают конкретно из-за переизбытка.

My web page; new

37. Kurtzberg J. concerts at the cord blood Connect 2018, phacilitate 2019, “https://StemCellCostInsights.com/” and the Perinatal Stem Cell Society

2019 conferences.

1. Embryonic stem cells (ESC) are https://StemCellExpense.com/, most often applied at the very very initial stage of development.

because of the common healing qualities of https://StemCellTherapyInCanada.com/ of skin wounds, for

example, in skin cancer, with stem cells.

а среди декоративных деревьев и кустарников выделяют:

клематис Пурпурея Плена

Элеганс, голубую ель Колючая Мисти Блу,

тую Смарагд,.

Also visit my blog; https://forum.ee/blog/929/entry-48833-vibor-plodovih-sazhentcev-kakie-pokazateli-vazhn/

↑ Исследование рынка коммерческой микромобильности http://setka.pp.net.ua/forum/53-6205-1 в крупных городах

(рус.).

Количество оборотов пильного диска.

отличие только в пропускной способности и мощности.

Here is my web blog – https://poemauh.cz/www-jettools-com/kak-vybrat-stanok-cirkuljarnyj-dlja-vashej/

Dr. Adam Purcho introduces the benefits of stem cells

and “regenerative medicine” for treating joints without the https://AutismTherapyCanada.com/.

Нареканий от клиентов не переводятся, https://www.m4ygear.nl/kupit-diplom-easi/ поскольку обслуживаем на высоком идейно-художественном уровне.

Некоторые спешат купить корочку, другие желают разобраться

в высшее учебное заведение.

Feel free to visit my web blog – https://digiinfomedia.online/kupit-diplom-imjef/

dano ljekoviti kompleks sadrži aktivni sastojak sildenafil

citrat, koji pomaže opustiti krvne žile i poboljšati dotok krvi u penis, kamagra 100mg oral jelly sildenafil tako postiže se i održava se erekcija.

For example, the https://StemTherapyPricing.com/ (with application of your

own stem cells) can range from 5,000 to 25,000 USD per treatment session.

In 2025, color trends will change, reflecting our changing lifestyle, wishes and current state

of affairs in the world. A bohemian production is a vibrant, artistic, Bella Staging and unconventional.

Have you ever considered about including a little bit more than just

your articles? I mean, what you say is fundamental and all.

But think of if you added some great images or videos to give your posts more, “pop”!

Your content is excellent but with pics and

videos, this blog could certainly be one of the best in its field.

Very good blog!

I’ve been surfing online more than 2 hours today, yet I never found any

interesting article like yours. It’s pretty worth enough for

me. In my opinion, if all web owners and bloggers made good content as

you did, the net will be a lot more useful than ever before.

I constantly spent my half an hour to read this web site’s content every day along with a

cup of coffee. https://Xeuser.gajaga.work/index.php?mid=board&document_srl=532373

Bella Staging is about creating

a space which it will become unique for you,

where any detail tells its historical background and makes its contribution to

the unified harmony of your house.

একটি অনলাইন ব্যক্তিত্বের

সাথে একটি ইতিবাচক খ্যাতি

হল অত্যন্ত প্রয়োজনীয় ভিন্ন কারণে: প্রথম,.

Also visit my page – https://travelpro.mx/jeetbuzz-%E0%A6%B2%E0%A6%97%E0%A6%87%E0%A6%A8/

ATTENTION: sda steam download already is not supported and not will receive updates.

Incredible a lot of amazing data.

Visit my webpage … https://www.turrgimnazium.hu/index.php/component/k2/item/1480?start=0

Если есть вопросы, https://khabmama.ru/forum/viewtopic.php?t=260308 звоните нашим работникам

с 9:00 до 18:00 по будням.

70918248

References:

https://wedioz.com/@maribelredding?page=about

70918248

References:

https://kimclasses.com/@shennablakey07?page=about

70918248

References:

injectable anabolic steroid, https://kifftondate.com/@siennahollis9,

сочетание с этим материалом, и специальная водозащитная обработка

делают пиломатериалы бонг для курения весьма долговечными.

4. Корпоративные издания.

Also visit my website; блокнот с кольцами

в итоге на тот факт, дабы купить диплом об образовании в москве в нашей

стране, изготовить его и доставить, уйдёт достаточно несколько.

а, https://gitlab.aicrowd.com/-/snippets/320347 Восток казино старается сделать игру

максимально комфортной и очень выгодной для своих

игроков.

“an incendiary continuation of the masterpiece the very beginning of the current millennium “voodoo”, created by the author of music spirit of funk D’Angelo, it would be sexy – the song is a slow seduction inspired by Marvin and Al, and/and a.

Feel free to visit my web blog :: https://porno-sex-blog.com/video/?p=Inked+redhead+licking+female+fake+cab+driver

Vip-ის ყურადღებისა და მოვლის წყალობით georgian escort ვინ სიყვარული, რათა თქვენი დრო პროფესიონალურად.

Register mailing address: Register by specifying the email

address, then log in to system and start place bets on competitions or need to

the gaming community at Mostbet Casino BD.

What’s Going down i am new to this, I stumbled upon this I’ve discovered It

positively useful and it has aided me out loads.

I hope to contribute & help other users like

its helped me. Good job.

Непосредственно веб сайт поддерживает только русский и английский языки, мультиплатформенное ПО представлено

а еще на казахском,.

Also visit my web page :: https://aroeats.net/aroeats/pokerdom-vse-o-luchshih-stiljah-igry-i-turnirah

если вы ожидали этого,

некогда тряскую, теперь знакомую смесь жанров, https://vk.link/twincasino

то она… ↑ metcalf, mitch. updated: showbuzzdaily’s top 150 sunday cable originals

При одноразовій затримці платежу банк

може підходити до подібного лояльно, кредити з поганою кредитною історією але регулярні.

многие не могут отыскать в

списке свой где купить диплом о высшем образовании диплом.

70918248

References:

supplement steroid – https://kaymanuell.com/@chastitymcinti?page=about –

Die spezifischen Werte variieren/schwanken ausgehend von/abhängig von Spaß/Spiel in Casino Verde freispiele ohne einzahlung.

Районный суд удовлетворил требования прокурора признать информацию запрещенной к размещению по всей территории рф,

купить аттестат о.

Look into my web site :: купить аттестат о среднем образовании старого образца

ние произвеждаме компоненти и части

на 2-3, 4,5 оси https://vtm-balancing.com/de/stands/balancing-machines-by-applications-de/auswuchtmaschine-fuer-zweimassenschwungrad-bvi-03-80m6/

Машини с ЦПУ.

70918248

References:

Anabolic Steroids Benefits – http://sayohyeah.asuscomm.com:3000/danielleguyton,

in the case when you want internet games, choose Top Casino Platforms in UK.

many resources excellently offer high-quality activities with real dealers from trusted suppliers, like evolution gaming.

if you have http://trentonktpw079.yousher.com/grodno-lenspcby-2, then most likely, the landlord already has interest in some specific things.

Choose the one that best suits your palms bet бонус код.

This free hacking course is for beginners assist you will master

all the concepts of ethical hacking by https://moiafazenda.ru/user/sandirqzai.

among other chicken road spel casino – betus, bovada and mybookie, which are have long been known for their convenient platforms and

interest options bookmakers.

вы можете совершить операцию обмена и оформить нужную вам криптовалюту

фактически моментально, обмен криптовалют Киев что увеличивает.

One lucky winner will also receive a trip to San Antonio

to to watch the Final Four match online on the fablous bingo.

So that google can easily find users ai content for seo.

you besides this have the opportunity to add custom instructions to chatgpt in order

to even more replenish and refine own results.

70918248

References:

best place to inject steroids – https://git.pegasust.com/reyeslyng3747,

70918248

References:

https://lekoxnfx.com:4000/jaiweiss673430

70918248

References:

https://git.mtapi.io/leathapoole64

Fantastic goods from you, man. I have be aware your stuff

previous to and you’re simply too excellent. I

actually like what you have received right here, certainly like what

you are saying and the way in which in which you

assert it. You make it enjoyable and you continue to take care of

to stay it smart. I cant wait to learn much more from you.

That is really a tremendous site.

70918248

References:

woman on steroids [http://my.muyin-2024.cn/eunicevonstieg]

ARLINGTON – exactly that Christian Campbell scored

his first Major League goal on Saturday night at Globe Life Field was obvious both due to the loud impact of the bat, similarly because of how happy the number 7 candidate

in the mlb pipeline has.

my webpage; https://csharpcoderr.com/35981/

Before utilizing oxandrolone, tell your physician or pharmacist if you are allergic to it; or if you have another allergies. This product may include inactive elements, which might cause allergic reactions or other problems. If you discover other results not listed above, contact your physician or pharmacist. Rarely, males could have a painful or prolonged erection lasting four or extra hours.

Assume of anabolic steroids, and the name Dianabol (Dbol) is usually the first to come to your thoughts. It’s long been the most well-liked and revered steroid, and for good purpose. The good factor about the latter is when accomplished with three or four weeks off cycle, a brief and steady cycle reduces well being and unwanted effects dangers to the bottom potential stage. Proviron, as a end result of it being an oral steroid and failing to convert into estrogen, ends in significant increases in total cholesterol (with HDL levels decreasing and LDL levels spiking).

Elevated levels of testosterone always ends in extra strength, size and performance throughout exercises. If you carry weights or you’re on the bodybuilding scene, you’ve nearly actually heard of Anavar. This is probably considered one of the most-talked about steroids and is whispered about in numerous gyms everywhere in the world. Anavar isn’t broadly often identified as a strength-enhancing steroid, but it excels in this regard, and one cause is that the ATP uptake in muscle cells is elevated.

However, individuals with robust genetics could not experience male sample baldness. Nevertheless, if a person abuses Anavar with extreme dosages, endogenous testosterone recovery just isn’t sure. Some novices might utilize an Anavar-only cycle, with it posing much less toxicity than other anabolic steroids. Nonetheless, Anavar still causes potentially troublesome unwanted effects (which are detailed in the unwanted effects part below). Anavar’s muscle positive aspects will be slightly lower than Winstrol’s, with fats loss being roughly equal. Anavar is extra generally utilized compared to Winstrol, which may be attributed to it being a less toxic compound and utilized by each sexes. We have discovered that many anabolic steroids trigger virilization-related unwanted effects in women, with Winstrol also falling into this category.

Furthermore, there are oral steroids that do not pose great dangers concerning hepatic (liver) damage, thus providing a more handy method of entry. Anadrole re-creates the results of Oxymethalone (known as Anadrol, one of the highly effective anabolic steroids in existence) but with out the unwanted effects. Anavar can also influence cholesterol levels, decreasing HDL (good) cholesterol and rising LDL (bad) cholesterol.

Nonetheless, it must be talked about that oxandrolone is considered a poor “bulking” steroid amongst male bodybuilders. However then again, it’s a very good drug for ladies who wish to add lean muscle mass. Now that we have coated the basics of Anavar and how it works, let’s further discuss the benefits, side effects, bodybuilding/sports usage, dosage and legality. Anavar is taken into account one of the milder anabolic steroids, but it nonetheless carries potential dangers, including liver strain, ldl cholesterol points, and hormone suppression.

For instance for an off-season ice hockey participant, or for a rugby participant the outcomes could additionally be more welcomed during this part of the season. Anavar might help repair muscle harm through training and allow most of these athletes to coach more durable, and extra frequently. It can help repair muscle damage after a player receives and impact damage i.e. from a physique examine, fall or quick paced collision.

As A End Result Of of the quick length of those cycles, typically now not than 4 to six weeks, solely short-acting or fast-acting steroids are used. These compounds begin working shortly, thus making it potential to attain fast gains. Cytomel (Liothyronine Sodium) can additionally be not an anabolic steroid within the conventional sense in that it isn’t based mostly on testosterone. Instead, it’s a synthetic type of the thyroid hormone triiodothyronine.

It has a excessive anabolic ranking, however this doesn’t translate into powerful anabolic effects that may rival those of true bulking steroids (which are almost all the time injectables). It’s enjoyable to take a glance at earlier than and after photographs of individuals who’ve used Anavar, however this tells us nothing about any positive aspects in energy they’ve skilled on the cycle. So, we all know that Anavar is insanely effective at delivering outstanding results, but at the finish of the day, steroids aren’t for everyone. Positive, we all want the results, but a lot of guys still won’t make the leap into really using a steroid like Anavar. Nevertheless, at excessive doses, Anavar nonetheless poses a danger for women, however at low doses, females are recognized to use this steroid with minimal and even no unwanted aspect effects at all.

As a results of FDA stress on the anabolic steroid industry, it was removed from circulation after a while. Ben Johnson’s gold medal from the earlier year’s 100-meter race at the Seoul Olympics was revoked as a outcome of his use of winstrol. From the FDA’s standpoint, this event seemed to be the final straw that broke the camel’s again. It is a substance that is classed as each an androgen and an anabolic steroid, and it is utilized in a wide range of contexts to stimulate weight gain.

The effects of oxandrolone on the expansion hormone and gonadal axes in boys with constitutional delay of growth and puberty. This is more frequent with Instagram models or individuals often showing on journal covers. There is excessive strain on these people to continuously look in wonderful situation, so they utilize Anavar as somebody would with testosterone on TRT (testosterone substitute therapy). We have discovered that valerian root dietary supplements may be efficient for mild insomnia, decreasing the time taken to go to sleep and the quality of sleep (36, 37).

References:

https://eyeobd.com/employer/best-time-to-take-anavar/

It is usually used to increase muscle mass, power, and endurance in athletes, bodybuilders, and fitness lovers. Proviron and Anavar are two popular anabolic steroids used by bodybuilders and athletes. Trenbolone and Anavar could be stacked collectively during bulking or slicing cycles, resulting in appreciable fats loss and super gains in muscle mass. Nonetheless, due to the presence of trenbolone, we think about this to be a harsh cycle and never appropriate for novices. Thus, if trenbolone is going to be used, it could as nicely be integrated in a bulking cycle; where its results are maximized in regards to lean muscle positive aspects. However, customers who’re the exception and tolerate trenbolone well or aren’t concerned with their health might use it during chopping cycles. Winstrol’s anabolic effects come without a notable surge in water weight, allowing lean and aesthetic gains instead of bloated-looking muscle tissue.

Winstrol may be a extra sensible choice for many who want a tougher minimize but are keen to danger extra unwanted effects. Whereas each Anavar and Winstrol occupy an identical area in the health sector, each carries distinctive effects. Anavar creates substantial energy gains but with gentle bodily modifications, whereas Winstrol shines in fat reduction and lean muscle preservation. The thought behind utilizing Winstrol and Anavar collectively is to blend the beneficial effects of both, creating a synergy that probably enhances the positive outcomes. Maybe the starkest distinction between these two is the nature of their impacts. Winstrol, to start with, primarily serves as an distinctive fat-burning agent whereas promoting the maintenance and definition of lean muscle mass. On the flip facet, Anavar’s energy lies in subtly fuelling strength and endurance—not essentially leading to bulkier muscle tissue, but certainly constructing a basis of persistent would possibly and stamina.

Anavar (Oxandrolone) and Winstrol (Stanozolol) are oral steroids, and of which Winstrol can be present in injectable type. Bodybuilders typically have a tough time selecting between the 2 as a outcome of they are so similar. To help you make your finest option for yourself, we’ll review the differences and key options of every. Some individuals refer to winstrol as a ‘poor-man’s anavar’, because it’s a much cheaper steroid.

It can be utilized by bodybuilders and athletes to extend muscle mass and energy. It does this by growing the core body temperature which in turn boosts the metabolic fee, resulting in the burning of more fats in addition to the manufacturing of extra power. It’s known for its capability to help burn fat and enhance muscle definition. Winstrol is effective for slicing as a outcome of it helps to increase your energy and endurance, permitting you to work out harder and burn extra energy.

By planning well, sticking to the best doses, and checking your health often, you can attain your objectives safely. This method ensures a successful and protected journey to fitness excellence. It’s a smart choice for each guys and ladies because it has fewer side effects. Folks name it the ‘girl steroid.’ It’s a popular choice for those avoiding harsh unwanted effects.

Usually speaking, if you’re someone who’s seeking to maximize the potential advantages of taking this steroid then it may possibly take anywhere between four to 6 weeks; sometimes longer. So whether or not you are bulking or cutting, SARMs can be flexible in creating stacks, and even utilizing them individually, to boost pure bodybuilding significantly. While the side effects of Anavar and Winstrol are similar, there are some variations between the two.

Nonetheless, do not overlook that just like any chemical collaboration, this combination needs in-depth understanding and careful consideration of potential unwanted effects, together with continuous monitoring. Additionally, these compounds show differing side-effect profiles. Whereas Winstrol can occasionally give rise to joint ache and trigger fluctuations in levels of cholesterol, Anavar doesn’t usually lead to such issues, largely because of its more lenient nature. Regardless Of these differences, both substances necessitate cautious utilization so as to keep away from potential antagonistic effects. From a productiveness standpoint, Anavar is well-regarded due to its capacity to boost power and power without introducing vital weight gain. This attribute makes it an ideal choice for these focusing on endurance quite than measurement, similar to boxers and cyclists. Winstrol customers will often endure from low natural testosterone production for several months post-cycle.

In this Winstrol vs Anavar comparability, you will discover that whereas Winstrol is a more powerful steroid than Anavar, it also has a lot of unwanted effects. Moreover, Anavar not solely has fewer side effects however can be utilized by women without the concern of virilization. That being said, the severity and incidence of side effects can range significantly between people, depending on genetic predisposition, life-style habits, and overall health standing. All accountable customers advocate for a cautious strategy and continual well being monitoring whereas adhering to such potent mixtures. Publish Cycle Therapy (PCT) comes into the image once the combined Anavar and Winstrol cycle concludes.

When Winstrol is stacked with testosterone, energy and muscle gains will be enhanced. Nonetheless, because of some probably water retention from the addition of testosterone, it’s more suitable for bulking. Lastly, there are a quantity of alternate options to those steroids which could be better suited to your needs. Carefully assessing your priorities and goals may help decide which compound is the better match for your desired health outcome. Regardless of the trail chosen, at all times apply intermittent monitoring and cling to beneficial doses. If you’re using Winstrol for slicing functions then lower doses are usually simpler (10-25mg); whereas if you’re using it for bulking then greater doses are sometimes beneficial (30-50mg). The results you will notice (or not) from taking Winstrol rely upon quite lots of elements.

Winstrol burns fat by slashing cortisol ranges, the hormone responsible for cussed fat storage. Its diuretic effect eliminates water retention, delivering onerous, defined muscular tissues. One facet impact that may occur with winstrol is that if you’re genetically predisposed to losing your hair; winny might pace up hair loss/thin your hair after a few cycles. Nonetheless, sensitive people who have observed this side effect have additionally reported that hair loss with winstrol may only be temporary; as their hair began to thicken again post-cycle.

Nevertheless, there are research suggesting clenbuterol has muscle-building effects in animals (32). Clenbuterol’s anabolic potential remains controversial, with our sufferers and a lot of bodybuilders failing to expertise any notable will increase in muscle hypertrophy throughout sensible settings. When anabolic steroids are taken with meals, absorption is inhibited. This is due to them being fat-soluble compounds, thus inflicting the steroid to dissolve when taken with dietary fat. Therefore, Anavar and other anabolic steroids ought to be taken on an empty abdomen for optimal outcomes.

Misuse or abuse of Anavar can result in severe health issues, corresponding to liver injury, mood changes, and heart problems. Even though Winstrol will STILL provide you with notable energy gains, it’s not its only property. And with Anavar, energy increase is certainly one of the few extremely pronounce advantages.

References:

https://gomyneed.com/profile/toniangabidj33

With its fat loss potency and ability to extend red blood cell production, Stanozolol ensures you’ll have the ability to work out longer, tougher, and yield impressive outcomes. Regardless Of having different paths, both Winstrol and Anavar result in elevated bodily effectivity. With Winstrol, customers may anticipate significant fats loss, improved vitality utilization, and enhanced muscle definition. In comparability, Anavar leans more towards sustainable power positive aspects, increased power, and enhanced performance without substantial weight positive aspects. Right Now, Anavar is primarily used by bodybuilders and athletes to boost their performance and enhance their physique. It is taken into account a mild steroid, which implies it produces fewer unwanted side effects in comparability with different steroids.

And I wouldn’t advise anyone to take the Anavar and Winstrol cycle provided that they’ve a doctor’s prescription. Most individuals experience some degree of water retention with most steroid medicines, including Anavar and Winstrol. We have found that many anabolic steroids cause virilization-related unwanted facet effects in women, with Winstrol also falling into this class. If we detect ALT/AST levels rising notably, bodybuilders at our clinic have had success taking TUDCA, which is a bile acid that has been proven to reduce stress on the liver (3). It is suggested not to stack Winstrol with some other oral steroids to stop excessive hepatic harm. Thus, Winstrol and Anavar will maximize muscle definition and vascularity, not like other anabolic steroids, as a end result of less extracellular fluid volume.

Therefore, any improve in muscle hypertrophy diminishes following cycle cessation. Pharmaceutical-grade Anavar was once synthesized by scientists in a licensed laboratory when it was legal for medical reasons. This was prescribed to sufferers suffering from cachexia, the place muscle loss was occurring at an alarming rate, rising the risk of mortality.

It can be used by bodybuilders and athletes to extend muscle mass and energy. It does this by increasing the core physique temperature which in flip boosts the metabolic price, resulting in the burning of extra fats in addition to the production of extra power. It’s identified for its capacity to assist burn fat and enhance muscle definition. Winstrol is effective for slicing as a end result of it helps to increase your power and endurance, permitting you to work out harder and burn more calories.

By planning well, sticking to the best doses, and checking your health regularly, you presumably can reach your objectives safely. This method ensures a successful and safe journey to fitness excellence. It’s a good choice for each guys and women as a end result of it has fewer unwanted side effects. People call it the ‘girl steroid.’ It Is a well-liked choice for those avoiding harsh unwanted effects.

This is probably considered one of the most-talked about steroids and is whispered about in numerous gyms all over the world. The size of your PCT will be determined by different steroids use, however normally, its cycle duration is for four to six weeks. This is a regular cycle that is adequate to allow regular testosterone levels back on observe. Anavar is a female-friendly steroid that not often produces virilization results, and the identical could additionally be for Tbol. Tbol is slightly more potent in nature so, Anavar is a safer compound for ladies, and additionally it is used for medical treatment. When taking two oral steroids collectively, it’s imperative to scale back each dose by half.

PCT helps restore pure testosterone levels, which can be suppressed in the course of the cycle and helps maintain the muscle features made. Long-term use of anabolic steroids can result in numerous well being points, together with liver harm, cardiovascular problems, and hormonal imbalances. So, it’s required to perform post cycle remedy on the finish of the Tbol cycle. When you carry out PCT on the finish of the steroids cycle, it may possibly assist you to to breed the pure testosterone degree and bring your physique back to its regular state. Typically, PCT is performed by the most typical medication similar to Nolvadex, Clomid, and HCG. Imagine getting into the realm of bodybuilding, aiming to carve out the final word physique. As you embark on this journey, you’ll undoubtedly come across a myriad of performance-enhancing substances, every promising distinct benefits.

Tbol might trigger slightly extra unwanted side effects than Anavar, similar to cholesterol, liver enzymes and further testosterone suppression. When utilized in a non-medical context, Anavar could be a hazardous drug with potentially fatal outcomes. Supplementing with TUDCA can provide some safety to the liver when taking Anavar, with a dosage of 500 mg/day being efficient (3). Often, Anavar will flush out extracellular water and shuttle fluid inside the muscle. When an individual stops taking Anavar, they won’t look as dry, and their muscle tissue won’t be as full.

Nonetheless, it’s wise to do not neglect that Anavar can nonetheless contribute to hair loss, relying on your predispositions. It’s essential to notice that correct post-cycle remedy (PCT) and liver protection supplements are important when utilizing either Anavar or Tbol. And as always, consult with a healthcare professional before contemplating using any anabolic steroid. Although Tbol is generally thought-about to be safer than different steroids, it’s essential to be aware of the potential unwanted side effects and dangers.

However, when it comes to the benefits of every compound, most agree that Winstrol is stronger. If you’ve any pre-existing health circumstances or are taking medicines, seek the guidance of your doctor to ensure it’s protected so that you just can use these steroids. As someone who has researched various steroids, I’ve found that selecting the best one could be a complex process.

Nevertheless, there are studies suggesting clenbuterol has muscle-building effects in animals (32). Clenbuterol’s anabolic potential stays controversial, with our patients and many bodybuilders failing to expertise any notable increases in muscle hypertrophy throughout sensible settings. When anabolic steroids are taken with meals, absorption is inhibited. This is due to them being fat-soluble compounds, thus inflicting the steroid to dissolve when taken with dietary fats. Therefore, Anavar and different anabolic steroids ought to be taken on an empty stomach for optimal results.